2024 State Of Ohio Employee Payroll Calendar

2024 State Of Ohio Employee Payroll Calendar - If you are not a member of the credit union, you can request a calendar from your payroll department (as long as they have made a supply request from us). Workday, finance, finance and supply chain reporting. Web 2024 state employee payroll calendar. 15 days after discontinuation of the business. Web in this article, we will explore the list of ohio state holidays in 2024 and explain their impact on public and private employees. Web to reconcile the school district income tax withheld and payments remitted by school district for the entire calendar year.

Web 2024 state employee payroll calendar. It has been published and is now available on the controller's website. Web state of ohio payroll projection system (sopps) the sopps reports provide estimates of employer costs that are calculated by individual employee (and vacant positions, if that option is selected) for the future biennium. Web in this article, we will explore the list of ohio state holidays in 2024 and explain their impact on public and private employees. Employers earning less than $323,000 annually in gross receipts must pay their employees the fair labor standards act’s minimum wage of $7.25.

The detailed fy24 period close and department fiscal payroll processing calendar is combined into one single calendar. Workday, finance, finance and supply chain reporting. Web in this article, we will explore the list of ohio state holidays in 2024 and explain their impact on public and private employees. We will also discuss the leave law in ohio and highlight which.

Web 2024 state employee payroll calendar. It has been published and is now available on the controller's website. We will also discuss the leave law in ohio and highlight which requirements you need to be aware of when you design your employee leave policies. Web in this article, we will explore the list of ohio state holidays in 2024 and.

The tax year 2023 deadline is january 31, 2024. Employers earning less than $323,000 annually in gross receipts must pay their employees the fair labor standards act’s minimum wage of $7.25. If you are not a member of the credit union, you can request a calendar from your payroll department (as long as they have made a supply request from.

Web 2024 state employee payroll calendar. Web state of ohio payroll projection system (sopps) the sopps reports provide estimates of employer costs that are calculated by individual employee (and vacant positions, if that option is selected) for the future biennium. Sopps estimates of payroll costs are found in bi cognos at: It has been published and is now available on.

Web to reconcile the school district income tax withheld and payments remitted by school district for the entire calendar year. Web in this article, we will explore the list of ohio state holidays in 2024 and explain their impact on public and private employees. The tax year 2023 deadline is january 31, 2024. Employers are required to file by january.

2024 State Of Ohio Employee Payroll Calendar - If you are not a member of the credit union, you can request a calendar from your payroll department (as long as they have made a supply request from us). Web 2024 payroll processing schedule. Web to reconcile the school district income tax withheld and payments remitted by school district for the entire calendar year. Employers earning less than $323,000 annually in gross receipts must pay their employees the fair labor standards act’s minimum wage of $7.25. Workday, finance, finance and supply chain reporting. Sopps estimates of payroll costs are found in bi cognos at:

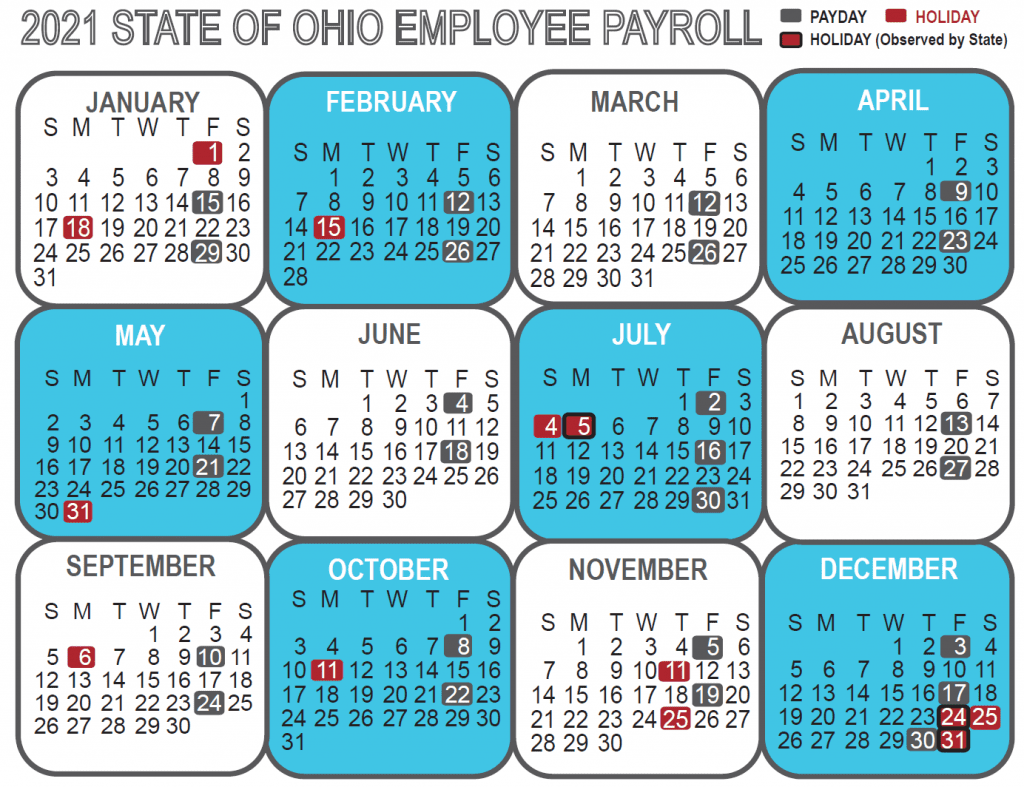

The detailed fy24 period close and department fiscal payroll processing calendar is combined into one single calendar. Web in this article, we will explore the list of ohio state holidays in 2024 and explain their impact on public and private employees. Employers earning less than $323,000 annually in gross receipts must pay their employees the fair labor standards act’s minimum wage of $7.25. Workday, finance, finance and supply chain reporting. Web 2024 state of ohio employee payroll payday holiday s 1 8 15 22 29 m 2 9 16 23 30 t 3 10 17 24 31 w 4 11 18 25 t 5 12 19 26 f 6 13 20 27 s 7 14 21 28 december s 3 10 17 24 m 4 11 18 25 t 5 12 19 26 w 6 13 20 27 t 7 14 21 28 f 1 8 15 22 29 s 2 9 16 23 30 november s 6 13 20 27 m 7 14 21 28 t 1 8 15 22 29 w 2 9 16 23 30 t 3 10 17 24 31 f 4 11 18 25.

Web 2024 State Of Ohio Employee Payroll Payday Holiday S 1 8 15 22 29 M 2 9 16 23 30 T 3 10 17 24 31 W 4 11 18 25 T 5 12 19 26 F 6 13 20 27 S 7 14 21 28 December S 3 10 17 24 M 4 11 18 25 T 5 12 19 26 W 6 13 20 27 T 7 14 21 28 F 1 8 15 22 29 S 2 9 16 23 30 November S 6 13 20 27 M 7 14 21 28 T 1 8 15 22 29 W 2 9 16 23 30 T 3 10 17 24 31 F 4 11 18 25.

Employers are required to file by january 31st of the following tax year or no later than. Web to reconcile the school district income tax withheld and payments remitted by school district for the entire calendar year. Web state of ohio payroll projection system (sopps) the sopps reports provide estimates of employer costs that are calculated by individual employee (and vacant positions, if that option is selected) for the future biennium. Web in this article, we will explore the list of ohio state holidays in 2024 and explain their impact on public and private employees.

It Has Been Published And Is Now Available On The Controller's Website.

2024 pay period schedule (pdf) 2023 pay period schedule (pdf) 2022 pay period schedule (pdf) 2021 pay period schedule (pdf) 2020 pay period schedule (pdf) 2019 pay period schedule (pdf). Web 2024 state employee payroll calendar. 15 days after discontinuation of the business. Sopps estimates of payroll costs are found in bi cognos at:

Web 2024 Payroll Processing Schedule.

The detailed fy24 period close and department fiscal payroll processing calendar is combined into one single calendar. We will also discuss the leave law in ohio and highlight which requirements you need to be aware of when you design your employee leave policies. The tax year 2023 deadline is january 31, 2024. Workday, finance, finance and supply chain reporting.

If You Are Not A Member Of The Credit Union, You Can Request A Calendar From Your Payroll Department (As Long As They Have Made A Supply Request From Us).

Employers earning less than $323,000 annually in gross receipts must pay their employees the fair labor standards act’s minimum wage of $7.25.