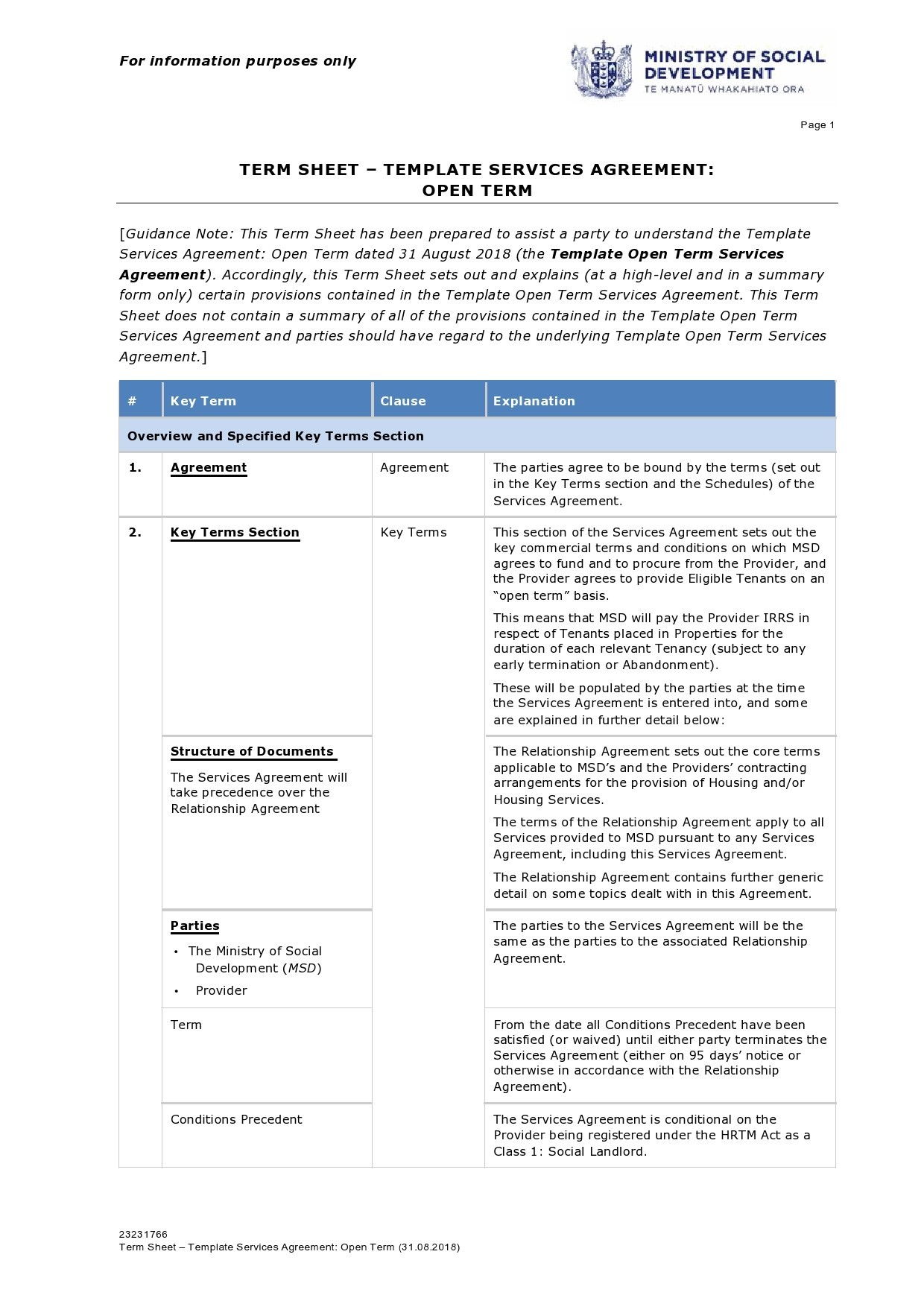

Term Sheet Templates

Term Sheet Templates - Web a term sheet is a document that summarizes the terms and conditions of a potential investment opportunity for investors. A term sheet is something that will affect you and your company for many years to come, so getting it right is crucial. What is a term sheet? A term sheet outlines the basic terms and conditions under of an investment opportunity and nonbinding agreement. Web get the term sheet templates. When you’re raising funds for your startup, a lead investor will use a term sheet to outline the key points of their offer to invest in your company.

They outline the basics of the investment deal and guide the preparation of the final agreement. Web components of a term sheet template. By jason kwon, aaron harris. When you’re raising funds for your startup, a lead investor will use a term sheet to outline the key points of their offer to invest in your company. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more.

Term sheet templates & examples. The term sheet is short, usually less than 10 pages, and is prepared by the investor. Using the document, you can establish control over your business, create open lines of communication with potential investors, and enhance the startup fundraising process. After giving a pitch for your organization and identifying potential investors, you will be required.

As a note, this is not legal advice and we suggest consulting with your lawyer while reviewing your term sheet. Swot stands for s trengths, w eaknesses, o pportunities, and t hreats. Creating a term sheet can be intimidating, but it offers immense benefits. Web a term sheet template is a document that outlines the primary terms and conditions of.

Founders don’t know what “good” looks like in a term sheet. These forms may be requested by our office or could be optionally submitted. After giving a pitch for your organization and identifying potential investors, you will be required to create this document as a. Web learn how to create a term sheet. You can download these best term sheet.

Web check out our breakdown of term sheet components with a few templates below. Using the document, you can establish control over your business, create open lines of communication with potential investors, and enhance the startup fundraising process. Web components of a term sheet template. Founders don’t know what “good” looks like in a term sheet. It helps provide a.

The term sheet is short, usually less than 10 pages, and is prepared by the investor. The term sheet serves as a template and basis for more detailed, legally binding. Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. A term sheet outlines the specific details about how the investor will make an investment into.

Term Sheet Templates - By jason kwon, aaron harris. From there, you can customize it to meet your needs. Web a term sheet template is a predesigned term sheet containing the essential clauses and conditions for the investment deal. When you’re raising funds for your startup, a lead investor will use a term sheet to outline the key points of their offer to invest in your company. Web learn how to create a term sheet. Creating a term sheet can be intimidating, but it offers immense benefits.

Web a term sheet is a document that summarizes the terms and conditions of a potential investment opportunity for investors. The term sheet is not typically legally binding. Swot stands for s trengths, w eaknesses, o pportunities, and t hreats. Using the document, you can establish control over your business, create open lines of communication with potential investors, and enhance the startup fundraising process. Web a term sheet template is a predesigned term sheet containing the essential clauses and conditions for the investment deal.

The Term Sheet Is Not Typically Legally Binding.

A general idea of how the transaction will play out might be included. The description section of your executive summary will also cover your management team,. Web a term sheet is a document that summarizes the terms and conditions of a potential investment opportunity for investors. Web components of a term sheet template.

Web You Can Include Pretty Much Anything You'd Like In A Term Sheet Template.

Web startup term sheet template | eqvista. It helps provide a snapshot of critical elements for the possible transaction which can then be developed into legally binding documents such as stock purchase agreements, shareholders’ agreements among others. Web below is what a series a term sheet looks like with standard and clean terms from a good silicon valley vc. Web learn how to create a term sheet.

Web Check Out Our Breakdown Of Term Sheet Components With A Few Templates Below.

A term sheet is something that will affect you and your company for many years to come, so getting it right is crucial. Learn the most important terms and clauses. They outline the basics of the investment deal and guide the preparation of the final agreement. A swot analysis can help you to challenge risky assumptions, uncover dangerous blindspots, and reveal important new insights.

Web Use This Sample Term Sheet Template To Negotiate The Important Terms Of Your Deal.

By jason kwon, aaron harris. A swot analysis involves carefully assessing these four factors in order to make clear and effective plans. Bracketed items (besides the names of the company and lead investor) are always or frequently negotiated. The contract outlines the key terms of the intended merger or acquisition.

![47 Simple Term Sheet Templates [Word] ᐅ TemplateLab](https://i2.wp.com/templatelab.com/wp-content/uploads/2020/04/term-sheet-template-26-790x1117.jpg)

![47 Simple Term Sheet Templates [Word] ᐅ TemplateLab](https://i2.wp.com/templatelab.com/wp-content/uploads/2020/04/term-sheet-template-29.jpg?w=790)

![47 Simple Term Sheet Templates [Word] ᐅ TemplateLab](https://i2.wp.com/templatelab.com/wp-content/uploads/2020/04/term-sheet-template-34.jpg?w=395)

![47 Simple Term Sheet Templates [Word] ᐅ TemplateLab](https://i2.wp.com/templatelab.com/wp-content/uploads/2020/04/term-sheet-template-30.jpg)